So, on Monday, the Daily Telegraph ran this story on how you too can incorporate your BTL portfolio as a limited company and dodge tax. You’ll note that the story only exists because mortgage broker Kent Reliance pushed a report at the paper. And yes, it’s totally about tax.

Kent Reliance, the buy-to-let lender who produced the report, also found that 11pc of landlords say they have already “incorporated”, or have moved holdings to a lower-rate-tax-paying spouse or partner to limit their tax exposure, while a further 25pc are considering doing so

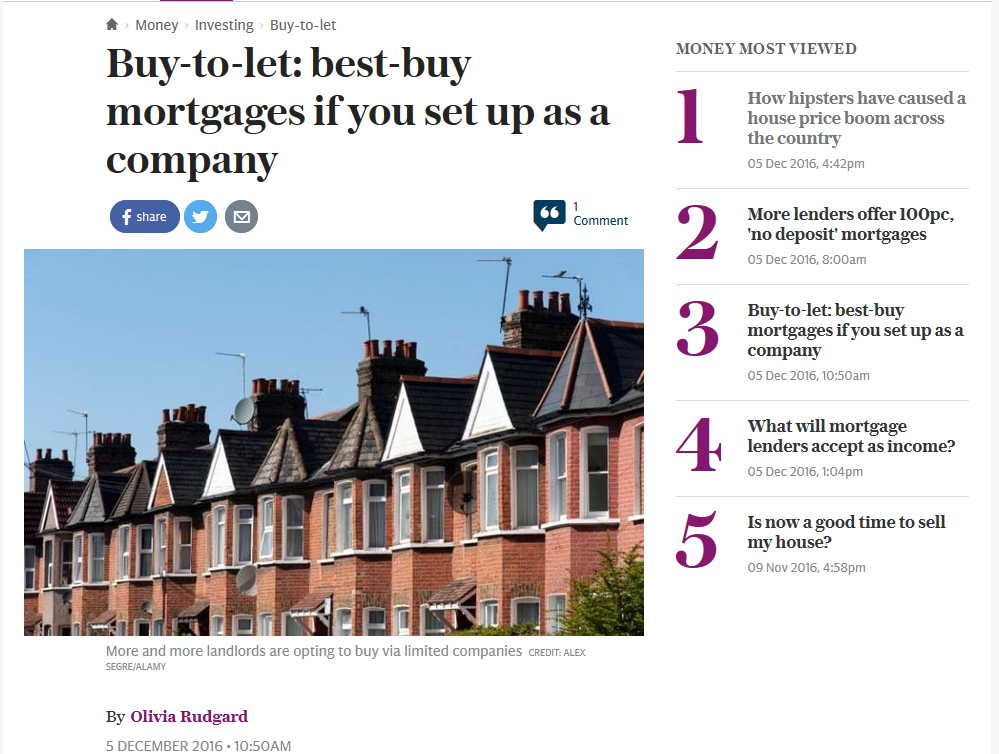

On the day, the top-5 sidebar next to the story looked like this.

If you’re going to incorporate in order to dodge tax, you might as well go large on the leverage and take out a 100% loan-to-value mortgage while you’re at it, eh. Also, don’t miss out on anything you could possibly include to juice the income multiple. After all, if anything about this worries you, why not blame it on the young’uns and their silly hair? They say no-one rings a bell at the top of the market, but the fifth story – “Is now a good time to sell my house?” – seems on point in the light of all this boosterism.

In case you’re wondering, literally all those stories are based on someone or other’s press release. It’s pure push journalism.

So, what might be in today’s paper? Well, who’s sent them something lately? Estate agents Haart, as it turns out. Revealed: the full shocking extent of the buy-to-let market collapse. I don’t know about you but I’d be pretty pissed off if I signed for that 100% mortgage on, say, Wednesday having read the paper on the Monday.

At least the Obscurer‘s advice column told the lady who was thinking of staging a spurious divorce to avoid stamp duty to bugger off. Honestly, people. There is such a thing as dignity and this ain’t it.

Permalink